© 2017 NPIS | Read our Terms & Privacy

Why invest in property?

There are so many financial benefits to investing in property in Australia.

Negative gearing allows people to borrow money to purchase an income producing property, to claim a tax deduction for many expenses they incur running that income producing property … including loan interest.

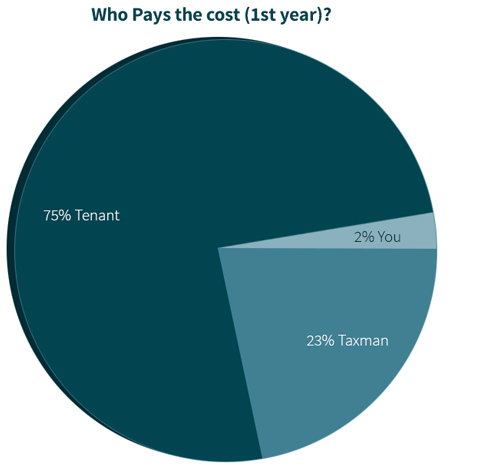

Your tax rebates, along with your rental income are used to pay off your loan, with only a small amount coming out of your own pocket.

In years to come your investment property will be paid for by your tenants, your tax deductions and the inevitable equity gains when your property value increases. All of this, in combination allows you, to enjoy a profit on your investment in which you can utilise in your retirement portfolio.

In the early stages of investing in a negatively geared property, your costs, like interest and so forth, are higher than the rental income you receive, so your property is negatively geared.

There are other ways to finance your property.

Neutral gearing happens when the costs incurred “running” your income producing property match the income that the property generates.

Positive gearing, occurs where the income from your property

actually exceeds the costs of running the property.

Whichever options you choose, your personal situation

will be assessed and the best outcome proposed.

I don’t have a deposit.

The good news with investment properties, is that you can unlock the equity in your home to fund the deposit. Without using your savings. Instead of finding a cash deposit, the Bank/Lender (subject to approvals) will allow you to use the equity built up in your home as security on your investment property.

I have heard property has not worked for some people.

At NPIS, we ensure that your financial structure is set up to best manage your investment. If it’s not set up correctly in the beginning, it will not perform the way you hope.

It is essential that your property investment performance minimises your ‘out of pocket’ expenses and maximises your potential capital growth. Some of the reasons property investments fail to perform as expected can include:

These mistakes can easily be avoided. Before investing, we will provide advice on which price range, which area and type of property are most suitable for your situation.

I’ve heard tenants can be a headache.

There is a lot of media hype out there in regards to tenants trashing houses, skipping out on the rent etc.

In general this is an anomaly, certainly not the general experience.

However, it is vital that your property is managed by a reputable property manager. When managed correctly you will have years of stress free leasing.

Vacancy issues are also reduced, when the property is managed properly. Your rental should be in a good location where there is a demand for rental properties; e.g. close to transport, shops, schools and employment.

There are some terrific insurance policies for investment properties, and then there are some so-so ones. We will advise you of your options to ensure that you get the best coverage for your peace of mind.